Singapore’s FY2025 Budget, presented by Prime Minister and Finance Minister Lawrence Wong, outlines significant measures to address cost-of-living pressures, provide support for businesses, and drive long-term growth.

With an emphasis on socio-economic inclusiveness and future-ready infrastructure, this year’s budget showcases a balanced approach to immediate challenges and strategic development. Here’s what you need to know.

Key Measures for Households

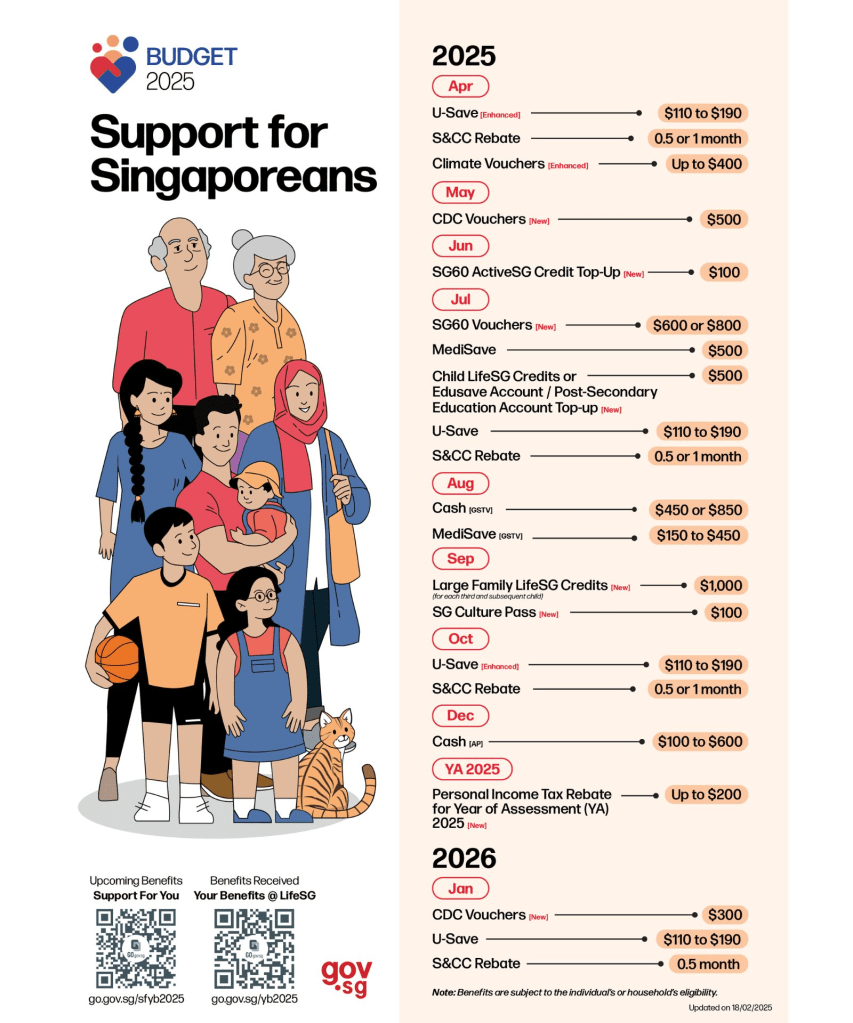

The Budget 2025 focused on providing financial assistance and alleviating costs for families and individuals, especially those who may be feeling the pinch from inflation. It also introduced targeted approaches for seniors, large families, and low-income households.

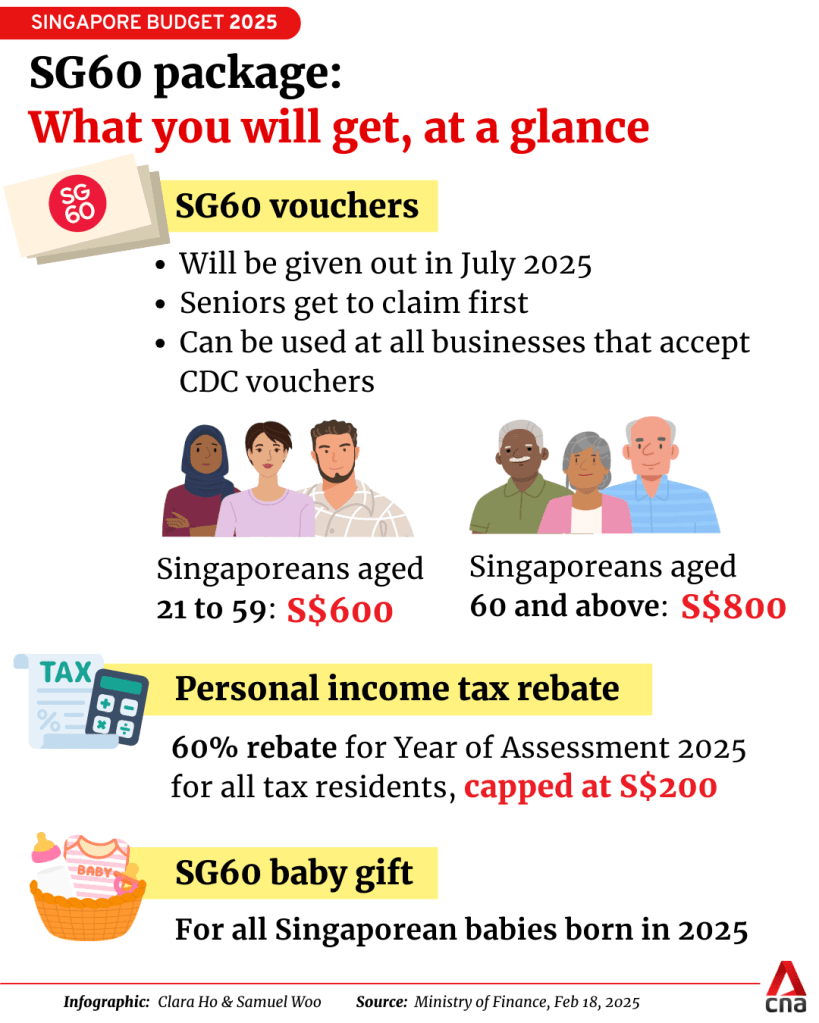

SG60 Package and Direct Support

As part of Singapore’s 60th anniversary celebrations, the SG60 Package offers direct financial relief to households. This includes cash disbursements for citizens aged 21 and above, community development council (CDC) vouchers, and utility rebates under the U-Save scheme, ensuring households have additional tools to cope with rising living expenses. These initiatives are designed to provide immediate relief while supporting longer-term financial resilience. For more detailed information on the SG60 measures, visit the Ministry of Finance website.

New Support Schemes for Families

Families with larger households will benefit from the Large Families Scheme, which offers subsidized childcare and education support, ensuring that parents have access to affordable resources. Additionally, matched Medisave contributions have been introduced to encourage savings for healthcare needs, particularly for families already managing multiple expenses.

Enhanced Tax Rebates and Relief

Budget 2025 also provides enhanced tax relief for individual taxpayers, including personal income tax rebates of up to 15%. These measures are aimed at reducing the financial burden on middle-income families and incentivizing positive financial behaviors. For more insights into how these tax rebates might affect you, DBS Bank offers a full breakdown tailored to individuals.

Measures for Businesses and Economic Growth

Singapore remains committed to maintaining its competitive edge as a global business hub. Key initiatives in the Budget are focused on helping enterprises manage costs, innovate, and grow sustainably.

Corporate Tax Rebates and Grants

To reduce costs for companies, Budget 2025 introduced a 50% corporate income tax rebate, capped at SG$40,000 per company, for the Year of Assessment 2025. Additionally, eligible businesses employing local staff will receive a SG$2,000 cash grant to alleviate immediate pressures. These moves aim to stabilize employment and boost overall market confidence. Businesses can discover further details from Grant Thornton Singapore’s summary.

Incentives for Innovation and Skills Development

Innovation continues to be at the forefront, with SG$3 billion allocated to the National Productivity Fund. This will support sectors like AI, R&D, and green technologies. Similarly, a refreshed SkillsFuture Workforce Development Grant offers enhanced funding for upskilling and re-skilling employees, ensuring Singapore’s workforce remains future-ready.

Infrastructure and Technology Investments

Infrastructure projects received a substantial boost, including a SG$5 billion top-up to the Changi Airport Development Fund for Terminal 5 expansion, which will bolster Singapore’s position as a global aviation hub. Additionally, funds like the Future Energy Fund and Coastal and Flood Protection Fund received top-ups to ensure sustainability and resilience against climate change. Learn more about these investments at The Business Times.

Sector-Specific Measures and Tax Adjustments

For industries such as real estate, maritime, and finance, Budget 2025 incorporates targeted measures to maintain Singapore’s competitive advantage on a global scale.

Real Estate and Maritime Sectors

Real estate stakeholders welcomed extended tax concessions for Real Estate Investment Trusts (REITs) to attract investment. Meanwhile, the maritime sector will benefit from an updated Maritime Sector Incentive (MSI) scheme, ensuring it continues to thrive amidst robust trade activities.

Initiatives for Fund Management and Financial Services

The financial sector saw incentives for fund managers and newly-listed firms on the Singapore Exchange, aimed at rejuvenating listings and improving market liquidity. A newly introduced Private Credit Fund will also assist in scaling high-growth enterprises.

Environmental and Transport Policies

Sustainability-focused policies marked significant steps, such as introducing road tax rebates for electric heavy goods vehicles. This complements Singapore’s broader net-zero objectives, aligning with clean energy and environmental strategies.

Personal Opinions

Although I understand that public policy is not easy, there has got to be a better way than just simply giving out money to the people. Optics wise, its no secret that it is election year, and judging by comments on other media outlets, this budget has been seen as a political scram for votes and affirmation by the PAP (NOT MY OPINION JUST AN OBSERVATION)

My stance on government transfers remain the same, there is potential risk of increased inflation with the use of cash transfers and I caution the government in continuing such policies. It may look good for them as to be seen as a benevolent government but its long term effects may be quite drastic.

Government cash transfers can potentially contribute to inflation by increasing aggregate demand in the economy, as recipients spend the additional money, which can lead to price increases if supply cannot keep pace.

Government transfers that are well researched and targetted which I hope the civil service has done may not show signs of significant impact on inflation. Only time will tell.

The other initiatives brought out are more than welcome with pushes towards achieving UN SDGs we shall see this general election how the Lawrence Wong Government will perform. Stay tune.

Conclusion

The FY2025 Budget strikes a cautious yet ambitious chord, balancing immediate cost-of-living alleviations with robust measures to secure Singapore’s economic future. With efforts ranging from direct household support and business-friendly policies to massive infrastructure investments, the government continues to position itself as a global leader in innovation, economic resilience, and sustainability.

As we move forward, Singapore’s strategic and inclusive vision ensures that both its citizens and businesses are well-prepared for the challenges of tomorrow. For a comprehensive summary, visit the official Singapore Budget portal.